Inclusion and impact are becoming widespread priorities in the investing world. With more and more funds considering gender as a factor in evaluation criteria and portfolio goals, the field of gender lens investing (investing to generate financial returns and a positive impact on women) continues to grow.

Project Sage 4.0, a new gender lens report researched by Wharton Social Impact Initiative and consultancy Catalyst at Large, quantifies the size and growth of the field. It also analyzes the field’s latest trends — including how it intersects with other elements of impact.

As with the three previous Project Sage reports, this fourth iteration is a landscape analysis of structured private equity, venture capital, and private debt funds with a gender lens. Just over 200 funds and structured vehicles were included in this latest study, with data collected through two milestone dates: December 31, 2020 and June 30, 2021.

“Research is one of our top priorities at WSII, and as fields like gender lens investing grow, we are proud to play this role in helping to quantify them,” said WSII Managing Director Sandi Hunt. “Stories and examples are very valuable, but it is also important to have data collected over time so you can measure growth and trends.”

Key Insights from Project Sage 4.0

1. THE NUMBER OF GENDER LENS FUNDS HAS INCREASED BY NEARLY 50%.

Project Sage 4.0 included data from 206 funds. This represents 49% growth from the 138 funds in Project Sage 3.0 (published in July 2020) and 255% growth from the 58 funds in the first Project Sage (published October 2017).

2. FUND SENIOR LEADERSHIP IS DIVERSE.

On average, 69% of a fund’s senior leadership identifies as female, 48% identifies as people of color, and 3.6% identifies as LGBTQIA+.

3. THE UN’S SUSTAINABLE DEVELOPMENT GOALS HAVE A STRONG PRESENCE.

Eighty-two percent of funds map their investments to the Sustainable Development Goals (SDGs), with funds selecting seven SDGs on average in the survey. Gender equality (SDG 5) was the top choice for funds, with 94% of respondents mapping investments to this SDG. SDG themes that cover “decent work,” “reduced inequalities,” “good health,” and “climate action” were also common, each selected by over half of the funds that map their investments to SDGs.

4. TOTAL CAPITAL RAISED HAS CLEARED $6 BILLION.

The total capital raised, among funds that provided this information, was approximately $6 billion as of June 30, 2021. While this represents a 25% increase from Project Sage 3.0, there is a substantial gap between the $6 billion funds had raised as of June 2021 versus their $13.2 billion fundraising targets.

5. FUNDS VARY IN THEIR DEFINITION OF GENDER LENS INVESTING.

There is a broad range of “gender lens” definitions. When asked, “How do you define gender lens investing?” funds selected more than one of the survey response options. And, not all funds use this gender lens investing language externally: Only 61% of funds reported that they refer to themselves as a “gender lens” fund publicly. Relatedly, 67% of funds publicly describe themselves as “impact investing” funds.

6. GENDER IS NOT THE ONLY COMPONENT OF DIVERSITY IN FUND STRATEGIES.

While 91% of funds prioritize gender as “critically important” or “very important” in their investment decisions, non-gender components of diversity play a significant role in the strategy of these funds.

Many funds’ investment criteria also include racial/ethnic diversity (47%). Some funds’ criteria also include LGBTQIA+ diversity (15%). Both of these numbers have nearly doubled from Project Sage 3.0’s data from 2019. And 17% of funds consider other forms of diversity in their investment criteria, including but not limited to indigenous populations, refugee populations, low-income populations, and more.

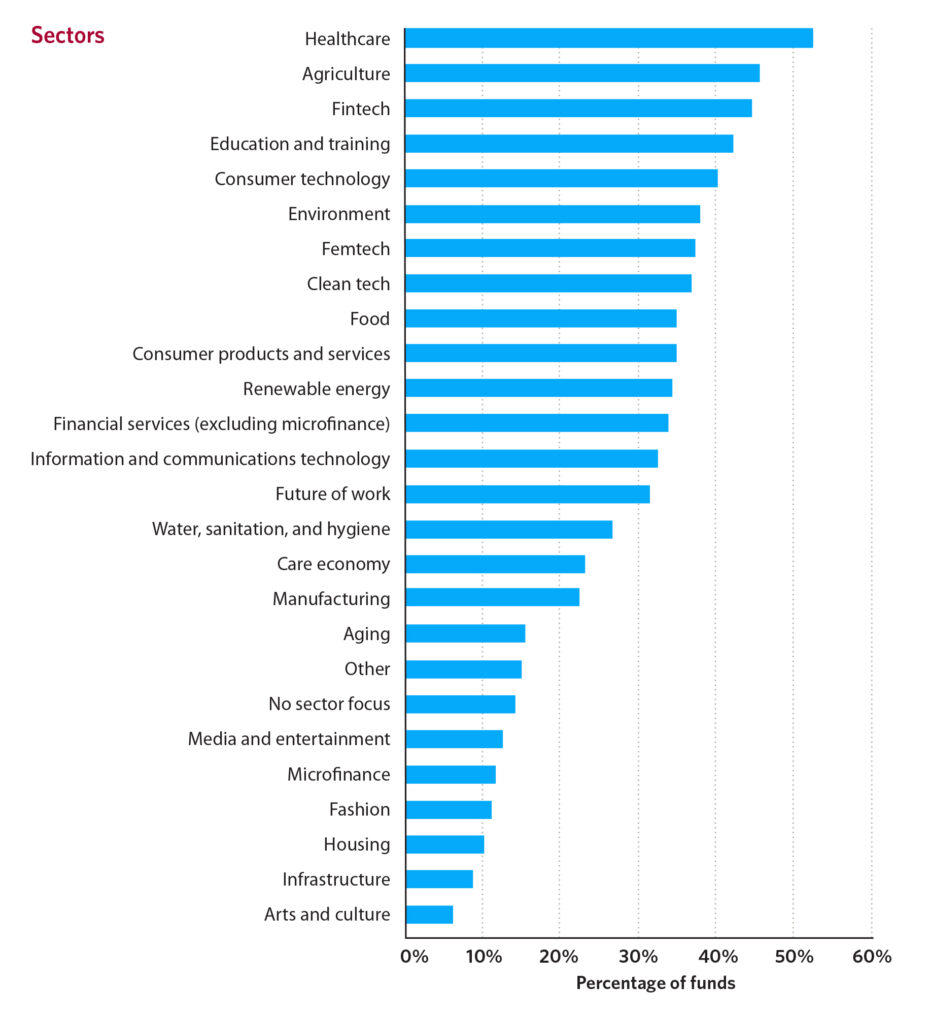

7. HEALTHCARE LEADS THE SECTOR FOCUS.

Funds reported investing in over 20 sectors. Healthcare, agriculture, and fintech were the top three focus sectors for funds. It is interesting to note the potential effects of COVID-19, with 25-30% of funds focusing on the “Care Economy” and “Future of Work” sectors.

Looking Ahead

Project Sage 4.0’s authors are excited to share this data on the field and hope it will be a useful tool for practitioners, a source of information for researchers, and a helpful analysis to anyone looking to learn more about gender lens investing.

“I’m excited by the growth in the field, the diversity of strategies and approaches, and the evidence that some funds lead with gender and others lead with climate, health, fintech, and more. I look forward to this being a tool for investors who are moving capital in this direction,” said Catalyst at Large CEO Suzanne Biegel, W’84.

A special thank you to Visa Foundation for their generous support of Project Sage 4.0.

Access the full report for additional insights and analysis:

— Nisa Nejadi

Posted: December 16, 2021